Flexible Spending Account (FSA)

For the 2025-26 Plan Year you can contribute up to $3,300 in pretax dollars towards the medical reimbursement FSA. You must login each year and elect a new contribution.

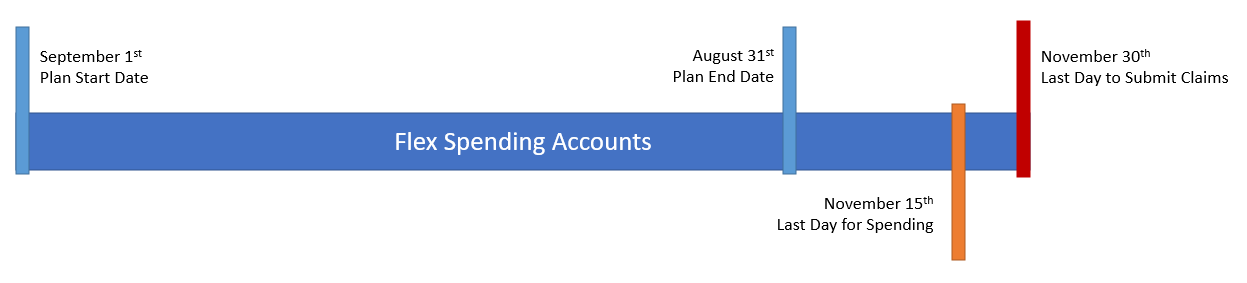

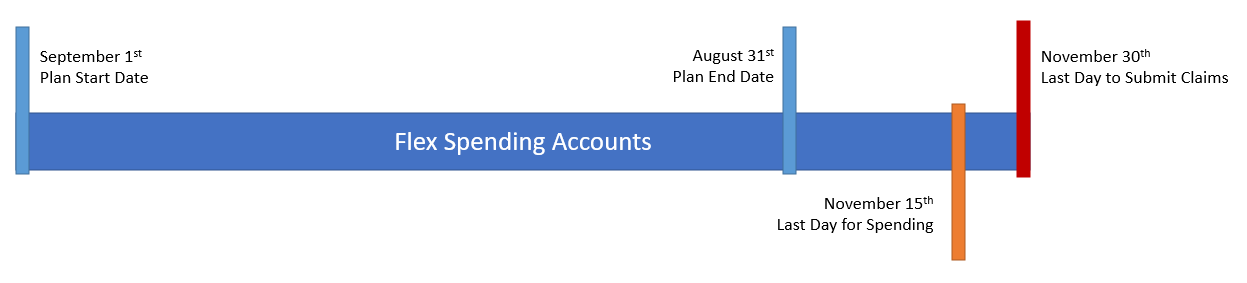

If you are not enrolled in a qualified high deductible health plan (The STAR plan), you are eligible to enroll in an Flex Spending Account. The FSA enables you to pay certain qualified medical expenses using tax-free dollars. Dependent on your personal tax rate, this can save you 10% to 30% or more on medical, dental and/or vision out-of-pocket costs. Funds will be available on the start of the plan year, September 1st (or the effective date of your plan with a qualifying event or new hire event). Funds MUST be used within 75 days from August 31st or you will lose your unspent contributions.

There is an admin fee of $3.20/month. If you elect more than $1,200/year, the district will pay that admin fee. If you elect under $1,200/year you will be responsible for that fee.

FAQ:

Q: How can I use my FSA funds?

A: You will receive a FLEX$ benefit card from PEHP (you can request 1 additional dependent card at no charge). With your FLEX$ enrollment, your existing card will automatically start accessing your new annual election amount. Keep your card, it is good for 3 years. You will be asked to provide documentation with all manual claims submitted and for card charges that cannot be independently verified. Keep receipts for all charges. For items not charged on the card, you pay the bill, complete the PEHP claim form (available on Insurance Services website under forms. Attach copies of your receipts and mail/fax to the address on the claim form. You will generally receive your reimbursement check or direct deposit within a week. Please be sure to keep copies of the claim form and receipt(s) for your records.

Q: How long do I have to use the money in my FSA?

A: You have until November 15th for spending your money and until November 30th to submit your claims.

Q: How do I know what I can spend my FSA funds on?

A: You can use your FSA for copays, coinsurance, glasses, dental work, orthodontics, medication and much more! This website is a great tool to know what is eligible! https://fsastore.com/

Q: When can I sign up for an FSA?

A: You can sign up during Open Enrollment. May 15th to June 15th, effective September 1st.

Q: I have a life event mid-year, can I waive my FSA during the plan year?

A: You can waive your FSA contribution if your spouse is starting a new job and enrolled in an FSA as a new hire. You can’t waive your FSA if the change for your spouse is due to Open Enrollment or if you are only going on your spouse’s medical coverage and not enrolling in their FSA.

If you need to submit a Flex Spending Reimbursement, please use this form:

PEHP Flex Spending Reimbursement Form

Other questions? Please reach out to PEHP's Flex Department at 801-366-7503.

Dependent Care Assistance Plan (DCAP)

For the 2025-26 Plan year you can set aside up to $5,000 in pre-tax dollars to pay for eligible dependent care (daycare) expenses. You must login each year and elect a new contribution.

With the Dependent Care account, you can set aside tax-free income to pay for qualified dependent care expenses, such as day care, that you normally pay with after-tax dollars. You must meet the following criteria in order to set up this account:

• You and your spouse both work;

• You are a single head of household; or

• Your spouse is disabled or a full-time student.

Qualified dependents include children under 13 and/or dependents who are physically or mentally handicapped and the expense must be incurred to allow you to work. If your spouse is unemployed or doing volunteer work you cannot set up a reimbursement account. Each calendar year the IRS allows you to contribute the following amounts, depending on your family status:

• If you are single, the lesser of your earned income or $5,000

• If you are married, you can contribute the lowest of:

• Your (or your spouse’s) earned income.

• $5,000 if filing jointly, or $2,500 if filing separately.

Unlike the FSA, the funds for daycare are not available until they have been deducted from your paycheck and posted to your account.

To submit a Dependent Care Reimbursement, please fill out this form:

PEHP Flex Spending Reimbursement Form